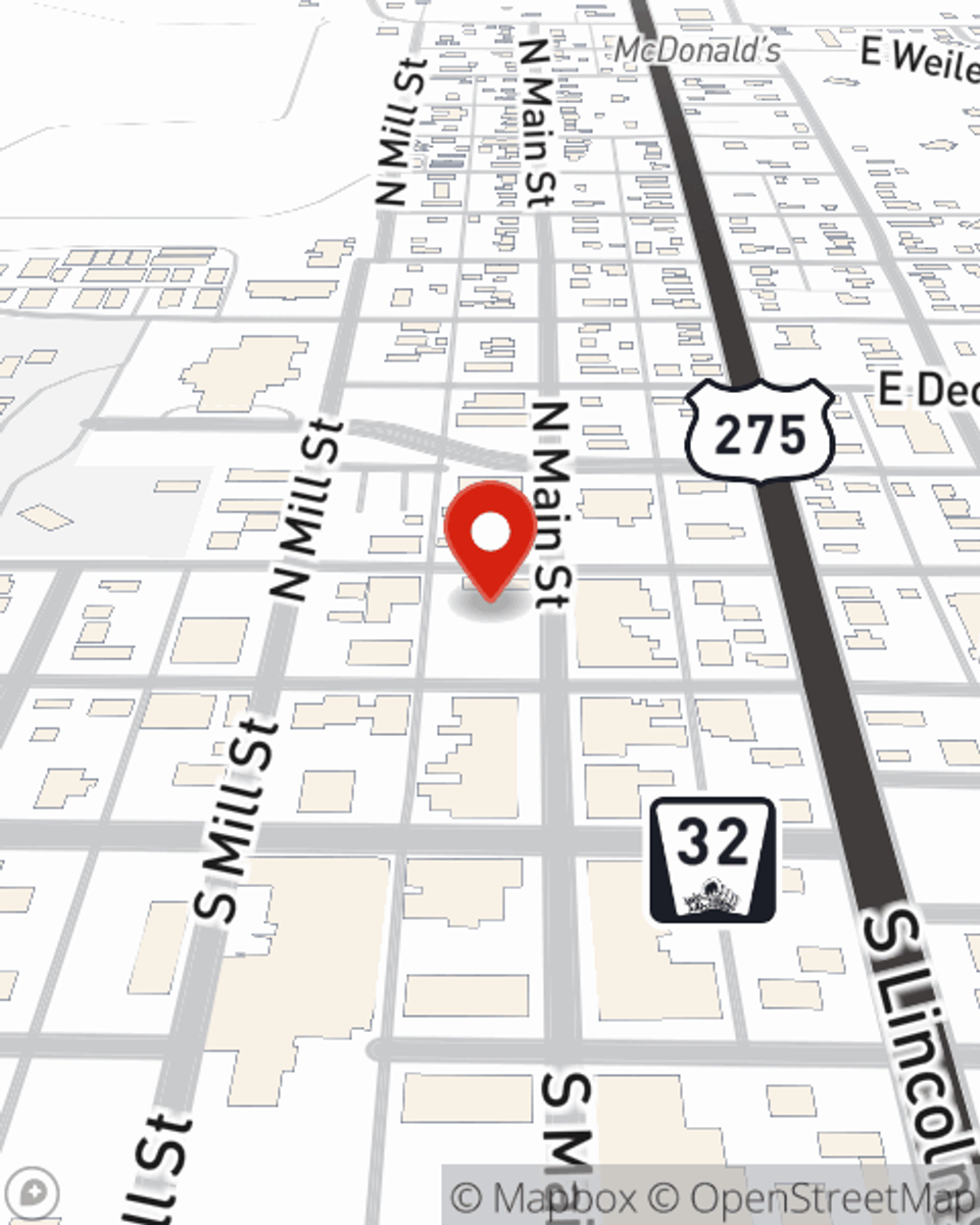

Business Insurance in and around West Point

Get your West Point business covered, right here!

Cover all the bases for your small business

- West Point

- Wisner

- Beemer

- Pender

- Dodge

- Cuming

- Oakland

- Scribner

- Snyder

- Howells

- Omaha

- Elkhorn

- Bennington

- Valley

- Fremont

- Lincoln

Insure The Business You've Built.

When experiencing the challenges of small business ownership, let State Farm be there for you and help provide terrific insurance for your business. Your policy can include options such as errors and omissions liability, worker's compensation for your employees, and a surety or fidelity bond.

Get your West Point business covered, right here!

Cover all the bases for your small business

Insurance Designed For Small Business

When you've put so much personal interest in a small business like yours, whether it's a donut shop, a music school, or a kennel, having the right protection for you is important. As a business owner, as well, State Farm agent Ryan Knispel understands and is happy to offer customizable insurance options to fit the needs of you and your business.

Get right down to business by getting in touch with agent Ryan Knispel's team to talk through your options.

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Ryan Knispel

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.